Recent 1 year of repost march 2022 to march 2023 total NPA non-performing assets bank Amount. Nearly by Rs .50000 crore to Rs 353874 crore involving 16883 account march 2023. As against Rs 304063 crore 14899 accounts in the march 2022.

Table of Contents

What is NON-PERFORMING ASSETS (NPA)

Money or loans provided by bank considered as assets as it generates income for the bank. if it has no problem or does not carry more than normal risk it is called standard asset if of ceases to generate income it become non-performing assets [NPA] in India

As a asset becomes non-performing when it ceases to generate income for the bank. Banks give loans and advances to borrowers. NPAs are loans and advances where the borrower has stopped making interest or principal repayments for over 90 days.

For agricultural loans the overdue for NPA is two crop seasons for short duration crops and crop season for long duration cores.

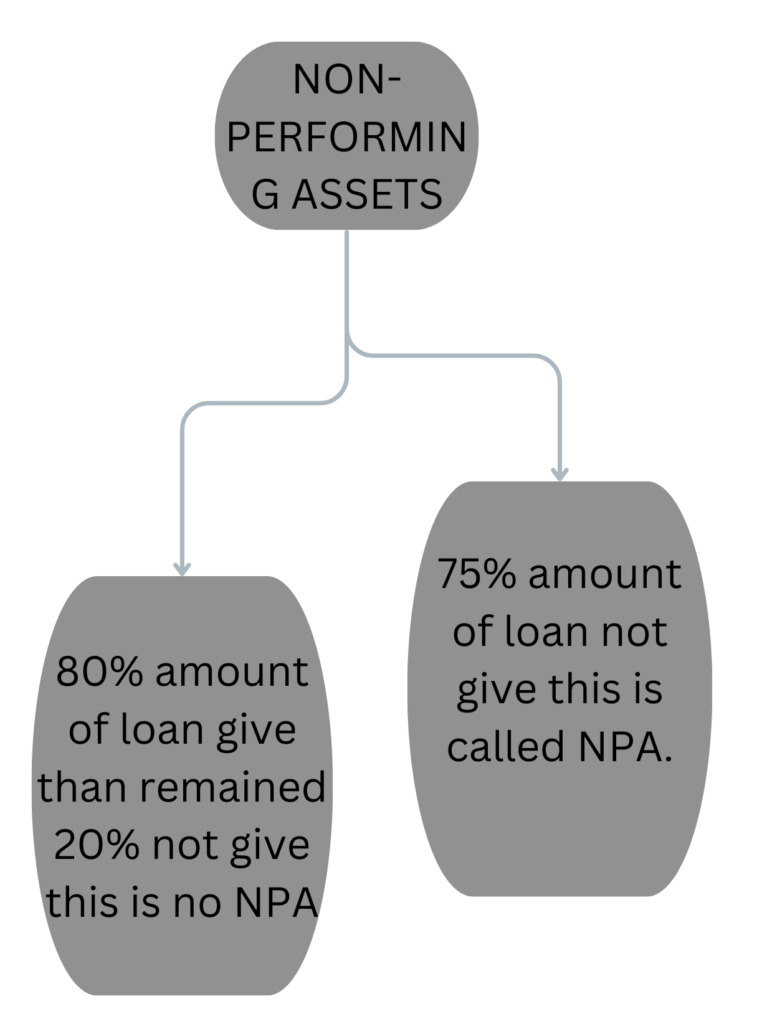

80% amount of loan give than remained 20% not give this is no NPA

But

75% amount of loan not give this is called NPA.

| Bank name | no of A/C | amount crore |

| SBI | 1921 | 79271 |

| PNB | 2231 | 41353 |

| UBI | 1831 | 35623 |

| Bank of Baroda | 2220 | 22754 |

| IDBI bank | 340 | 24192 |

| PVT bank | 2332 | 54250 |

| Nationallised bank | 11935 | 193596 |

Bank have filed suits against 35150 NPA account 926492 crore in march 2023

NPA account in which principal or interest is overdue for more than 90 days which declined 10 year low 3.9 % march 2023

According to RBI, NPA is a loan or an advance where

nterest and/ or instalment of principal remain overdue for a period of more than 90 days in respect of a term loan.

The account remains ‘out of order’ in respect of an Overdraft/Cash Credit (OD/CC).

The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted

The instalment of principal or interest thereon remains overdue for two crop seasons for short duration crops. The instalment of principal or interest thereon remains overdue for one crop season for long duration crops.

Categories of NPAs in India

Based upon the period to which a loan has remained as NPA, it is classified into the following 3 categories:

1. Substandard Assets

An asset which remains as NPAs for less than or equal to 12 months.

2. Doubtful Assets

An asset which remained in the Substandard Assets category for 12 months.

3. Loss Assets

As asset where loss has been identified by the bank or the RBI.

there may be some value remaining in it. Therefore, the loan has not been completely written off

NPA CRISIS IN INDIA

The gross NPAs of banks (as a percentage of total loans) have increased from 2.3% of total loans in 2008 to 9.3% in 2017.

As of March 31, 2018, the total volume of gross NPAs in the economy stood at Rs 10.35 lakh crore. About 85% of these NPAs are from loans and advances of public sector banks.

The reasons for rising NPAs in India include

Borrowed funds are not utilised for the purposes which they have borrowed.

Wilful defaults, siphoning of funds, frauds, misappropriation add to NPA.

Business failure because of overestimated optimistic projections.

Lack of skill on the part of the banks to monitor end use of funds and diversion by the borrower through web of shell companies and so on have contributed to India’s rising NPA.

TWIN BALANCE SHEET PROBLEM

The Twin Balance Sheet problem refers to the situation of “overleveraged companies” on one hand and banks with Non-Performing Assets on the other hand.

Banks also extended fresh funding to the stressed firms to tide them over until demand recovered. RBI’s 3R framework for tackling Twin Balance Sheet Problem

Rectification, Restructuring and Recovery Rectification

Asset Quality Review Restructuring:

The 5/25 Refinancing of Infrastructure Scheme

Corporate Debt Structuring

Strategic Debt Restructuring

Scheme for Sustainable Structuring of Stressed Assets

Private Asset Reconstruction Companies (ARCs) Recovery

SARFAESI Act 2002

Insolvency and Bankruptcy Code 2016

Debt Recovery Tribunals (DRTs)

The DRTs and Debts Recovery Appellate Tribunals (DRATs) were established under the Recovery of Debts and Bankruptcy Act (RDB Act), 1993 with the specific objective of providing expeditious adjudication and recovery of debts due to Banks and Financial Institutions.

Credit Information Bureau (2000)

It helps banks by maintaining and sharing data of individual defaulters and wilful defaulters.

Third party agencies such as CIBIL helps banks with data on the financial health of the borrower.

Lok Adalats (2001) These are helpful in tackling and recovery of small loans.

Sarfaesi Act, 2002 The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 provides the banks with a mechanism to better recovery of assets by enabling them to take possession of securities and sell them to reduce the burden of the NPA.

Asset Reconstruction Companies (ARC)

These companies are created under SARFAESI Act of 2002 to unlock value from stressed loans.

They buy bad loans and NPAs from banks and financial institutions to clear the balance sheet of the banks and financial institutions.

After buying stressed assets from banks, ARCs in return provide banks with 15% cash and 85% securities receipt against the amount of bad loans. ARCs are regulated by RBI.

Allows banks to extend the tenure of loans to 20-25 years to match the cash flow of projects, while refinancing them every 5 or 7 years making long-term infrastructure projects viable.

Joint Lenders Forum (2014)

It was created by the inclusion of all PSBs (Public Sector Banks) whose loans have become stressed. It is formulated to prevent the instances where one person takes a loan from one bank to give a loan to the other bank.

Mission Indradhanush (2015)

The Indradhanush framework for transforming the PSBs represents the most comprehensive reform effort undertaken to revamp the Public Sector Banks (PSBs) and improve their overall performance.

The reforms consist

Appointments Based upon global best practices and as per the guidelines in the companies’ act, separate posts of Chairman and Managing Director would be created.

The CEO will get the designation of MD and there would be another person who would be appointed as non-Executive Chairman of PSBs.

The Bank Board Bureau is a body of eminent professionals and officials, which will replace the Appointments Board for the appointment of Whole-time Directors as well as non-Executive Chairman of PSBs.

Conclusion

In India NPA ratio other than country high as result RBI guidelines in the companies improved day by day.

[…] if you read about non performing assets update 23. […]