75% of Beneficiaries of PM SVANidhi Scheme Come from Non-General Category with OBCs Accounting for 44%, says SBI Report

Table of Contents

What is PM SVANidhi

Pradhan Mantri Street Vendor’s AtmaNirbhar Nidhi(PM SVANidh), is a micro-credit scheme launched by the Ministry of Housing & Urban Affairs (MoHUA) in 2020 india.

The scheme aims to provide working capital loans to street vendors.

About 70 lakh loans (with a value of Rs 9,100 crore) were disbursed under the scheme.

The scheme offers an interest subsidy of 7% per annum on timely/early repayment of the loan.

Objective

To facilitate working capital loan up to 10000 at subsidized rate of interest.

To incentivize regular repayment of loan and reward digital transaction.

Features of pm SVANidhi

It is central sectors scheme, It was launched by the ministry of housing and urban affairs in 2020 for providing affordable working capital loan to street vendors to resume their livelihoods that have been adversely affected due to covid-19 lockdown

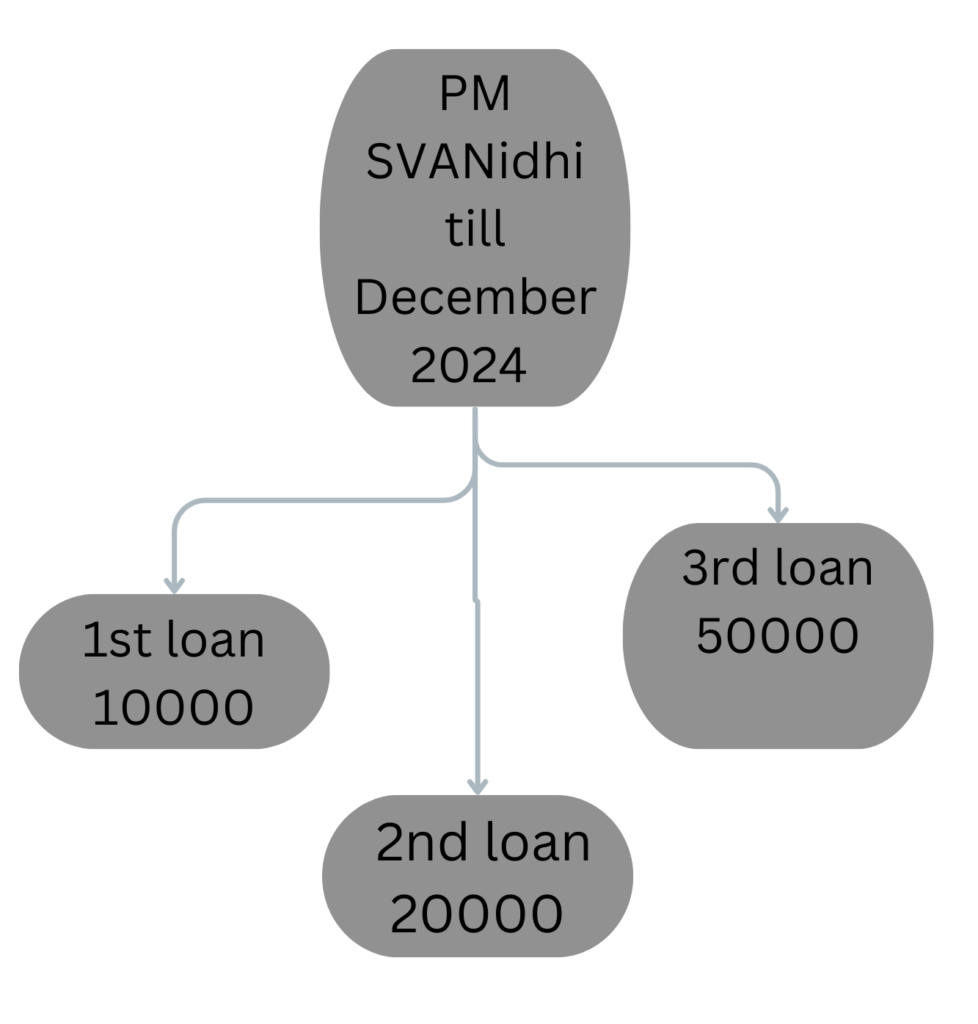

The scheme initially was until March 2022, but It has been extended till December 2024.

With the focus on 1st loan 10000 , 2nd loan 20000, 3rd loan 50000

Interest subsidy

The subsidy the vendors availing loan under the scheme are eligible to get an interest subsidy @7%.

Target

Street vendors , hawkers vending in urban area including the vendors of surrounding peri-urban and rural areas.

Which is institutions/ bank give to loan

Scheduled commercial bank, regional rural bank, small finance bank, cooperative bank, non-banking financial companies, micro-finance institution and SHG banks.

What is Eligibility

In certificate of vending / identity card issued by urban local bodies

Vendors left out of ULB led identification survey or who have started vending after completion of the survey and have been issued Letter of recommendation [LoR] to that effect by the ULB / town vending committee.

The vendors of surrounding development, per urban, rural areas vending in the geographical limits of the ULBs and have been issued LoR that effects by ULB/ TVC.

Recent Update 2023 PM SVANidhi scheme

75% of Beneficiaries of PM SVANidhi Scheme Come from Non-General Category with OBCs Accounting for 44%, says SBI Report. Strengthening the Country’s Social Fabric by Empowering Grass root Market Maverick 75% of the beneficiaries of the PM SVANidhi scheme are from the non-general category.

44% of the beneficiaries belong to the Other Backward Class(OBC) category.

22% of the total disbursement of the scheme benefitted people from Scheduled Castes(SC) and Scheduled Tribes(ST). It is to be noted that out of the total beneficiaries, 43% were women.

Persistency Ratio

The report says that 68% of people repay the first loan (of Rs 10,000) and take the second loan (of Rs 20,000.)

75% of people repay the second loan (of Rs 20000) and take the third loan (of Rs 50,000)

the increased ratio of (2nd loan/1st loan] indicates the need and popularity of PM SVANidhi Scheme.

Other Highlights

The average amount of money spent by PM SVANidhi account holders using their debit cards increased by 50%( to Rs 80,000) in the financial year 2022-23 as compared to the financial year 2020-21.

The average spending per annum increased by Rs 28,000.

the borrowers under the scheme the age group of 26-45 give the loan 65% roughly Two-thirds.

On average, 63% of people under age 25 and over age 60 spend more money after they receive a loan.

SVANidhi loan given to Pradhan Mantri Jan-Dhan Yojana (PMJDY) beneficiaries increased their average spending at merchant outlets, 5.9 lakh borrowers of this scheme are from 6 megacities; Varanasi topped the list.

Over 46.54 lakh small working capital loans have been disbursed to street vendors under the Prime Minister Street Vendor’s AtmaNirbharNidhi (PM-SVANidhi) in the three years since it was launched in June, 2020.

Out of the loans disbursed, about 40% (18,50,987) have been repaid so far.

Most of the loans disbursed and repaid so far are first-term loans – 36,26,653 disbursed and 17,67,241 repaid.

A total of 9,68,209 second-term loans and 59,440 third-term loans have also been disbursed till now.

While no third-term loans have been repaid so far, 83,746 second-term loans have been paid back.

Evaluation Of The Scheme On 3-Year Completion

In 10 states and UTs, almost all in the Southern and North-East region, women are the majority of the beneficiaries.

In the Kerala is an exception, but this state has been a pioneer in fostering women’s empowerment through its own programmes like the Kudumbashree.

The social fabric of the regions has a part to play in women outnumbering men in the number of beneficiaries. Some states, the local authorities targeted women’s self-help groups (SHGs) as beneficiaries.

Various Challenges in Implementing the Scheme

Uneven implementation of the Street Vendors Act across the states, The Act necessitates a survey of the vendors to issue a certificate of vending. However, many states and cities have not conducted the survey yet.

Some municipalities are also slow in issuing LORs, the absence of the survey, the urban local bodies (ULBs) can provide a Letter of Recommendation (LOR), if the vendor is a member of a vendor association

Street Vendors in India

Any person selling goods or services, who does not have a permanent shop is considered a street vendor.

There are an estimated 50-60 lakh street vendors in India, with the largest concentrations in the cities of Delhi, Mumbai, Kolkata, and Ahmedabad. Most of the street vendors across the country are migrants. Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014

to regulate street vendors in public areas and protect the livelihood rights of street vendors.

the Act, vending and non-vending zones have to be demarcated and all street vendors have to be accommodated in the vending zones.

As the reported by the States/UTs, a total of 13,403 vending zones have been identified so far.

The Act provides for a survey of all existing hawkers and certificates of vending are to be issued to all existing hawkers identified in the survey.

Further, no hawker can be removed from his/her spot unless and until the survey has been done and certificates of vending issued. In order to prevent harassment of street vendors, the Act states that no street vendor shall be harassed under any other law in force. Moreover, the Street Vendors Act will override any other law related to street vendors.

Town Vending Committees

The Act provides for the formation of Town Vending Committees (TVC) in various districts.

The TVC is headed by the municipal commissioner. Since the street vendors are the biggest stakeholders, members representing them should not be less than 40 per cent of the TVC. The TVC has to organizsed the survey, decide on vending/non-vending zones, issue vending certificates, decide on vending fees that the hawkers should pay the municipality, publish the street vendor’s charter etc.

[…] if you read about p.m.svanidhi scheme […]